Remember the cash for clunkers program Congress created in 2009 for your old beat up car. You brought in your clunker car to the dealer and got cash to buy a new car to stimulate the economy? It seems that the 100 year old income tax has become an obsolete “clunker tax” and is not working. The income tax needs to be replaced with a new tax better suited for the 21srt century, a National Sales Tax. Stay tuned to TaxView with Chris Moss CPA to find out why.

Historically income tax has always been somewhat of a voluntary tax. History shows most Americans when given the choice, choose not to pay. That is why in 1943 with the introduction of the W2 form in just two years revenue collection increased from $7 billion to $43 billion with 60 million Americans added to the tax rolls almost overnight.

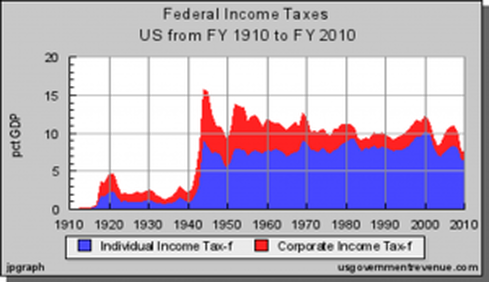

Congress realized the power of the W2 with revenue collections as a percent of Gross Domestic Product surging from less than 6% to almost 20%. Unfortunately Americans would fight back against the W2 form. Slowly an underground economy thwarted forced W2 withholding now estimated to total almost $2 Trillion a year in unreported income. Congress fought back as well.

Over the last 30 years there has been an attempt by the Government to “capture” all that underground income by creating the 1099 network of reporting hoping for another W2-like increase in collections as percentage of GDP. The ultimate 1099 program was enacted in 2010 when Congress tried to capture all income from everyone, but Congress soon realized this was impossible to enforce let alone comply with. That law was repealed a year later in 2011.

The fact is that it is impossible in the 21st century to capture all income from 1099s unless the IRS audits everyone. The solution? An involuntary national sales tax, taxed at the source of each purchase at the same time state sales tax is collected. Easy, simple and very effective. But just in case you’re not convinced yet that a voluntary income tax does not work in the 21st century, there’s more: Identify theft, a 21st century crime is further eroding income tax collections.

The Government is losing at least $6 billion a year to identity theft as organized crime has moved its operations from drug dealing to identity theft. John Koskinen, the Commissioner of the IRS has recently commented that he has heard from police that “street crime is down because everybody is now filing false IRS returns”. Add identity theft to the underground economy and the IRS is unable to collect enough money each year to allow America to pay its bills. Further add additional tax revenue being lost to off shore illegal tax shelters and you have the triple crown of tax evasion: Underground economy, identify theft, and offshore tax shelters. No wonder our National Debt is dramatically approaching the unthinkable $20 Trillion level.

A National Sales Tax might just wipe out the Underground economy as well as drive organized crime out of the United States Treasury. As an added benefit, all off shore money would soon return home and many if not all tax shelters would disappear back to the 20th century where they belong. If Congress were bold enough to embark on a 21st century solution to increase revenue collection, perhaps annual deficits would be wiped out as well. Could the dramatic rise in collections as a percent of GDP from 1943 be recreated in 2015 with a National Sales Tax?

I don’t know about you all, but I don’t want to see our Government cut services to Americans, including our military, just because Congress does not have the courage to see that the income tax has become a “clunker tax”. If you all believe that the income tax is now an obsolete clunker, let your elected representatives know how you feel. Perhaps House Ways and Means and Senate Finance can best serve America by creating a new tax better suited for the 21s century rather than trying to reform a 100 year old clunker.

Thank you for joining us on TaxView with Chris Moss CPA.

Kindest regards

Chris Moss CPA

RSS Feed

RSS Feed